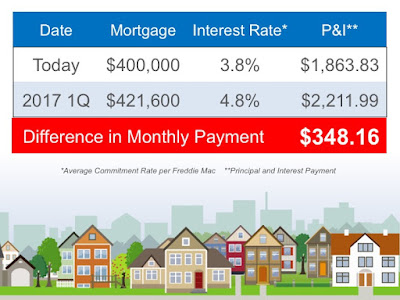

Why should you buy a home now?

It may cost you more if you wait. Below shows the projected monthly increase in a mortgage payment today versus 2017.

Wednesday, April 13, 2016

Tuesday, March 22, 2016

Taste of Nashoba

Taste of Nashoba

Nashoba

Valley is celebrating their 15th year of “Taste of Nashoba”. On March 22nd from 5:30-8PM, visit

Lawrence Academy to see what all of the local attractions have to offer! Restaurants, caterers, bakeries, and

breweries will all be showcased at this event.

Year after year the number of attendees grows, along with the

participants. Over 1,000 people attended

last year, and even more are signed up to stop by and engage in the fun this

year.

Will

there be any new additions this year?

Yes, there are several newcomers including Welcome Wagon, Vitamin 1,

Great Road Kitchen Oyster Bar and Grill, and many more. Along with the first timers, there are dozens

of returning vendors.

The Taste is the Chamber's largest and most popular social

engagement of the year, so don’t miss out!

Tickets are $25 dollars if you sign up in advance, or $30 at the

door. For more information on

sponsorship opportunities, contact Melissa at Melissa@nvcoc.com or call

978.425.5761

Here

is the list of who will be there:

•

110 Grill

•

Aaronap Cellars LLC

•

Annie's Gluten-Free Bakery

•

Bailey's Bar & Grille

•

Bridges By Epoch Westford

•

Bull Run Restaurant

•

Burtons Grill

•

Carlin's Restaurant

•

Carlson Orchards, Inc.

•

Charlotte's Cozy Kitchen

•

Coleman Catering

•

Concord's Colonial Inn

•

Devens Common Center

•

Devens Grill

•

DoubleTree by Hilton

•

Evivva Cucina

•

Gibbet Hill Grill

•

Golden Girl Granola

•

Groton Wellness

•

Holiday Inn Boxborough

•

Jack O'Lantern Wine & Spirits

•

Mariano's Ristorante

•

Nashoba Café @ Nashoba Valley Medical Center

•

Nashoba Park Assisted Living

•

Nashoba Valley Technical High School

•

Red Tail Golf Club

•

Rivercourt Residences

•

Shaker Hills Country Club

•

Shriver Job Corps Center

•

Slavin in the Kitchen

•

Stonehedge Inn

•

Sub Zero Ice Cream & Yogurt

•

Sunset Tiki Bar and Grill

•

The Great American Grill

•

The Red Raven

•

Union Coffee Roasters

•

Wachusett Brewery

•

Westford Regency

Tuesday, February 9, 2016

Tuesday, January 19, 2016

2016 Predictions - Mortgage Rates & Home Sales Rising with Refinancing Dropping

Over at CoreLogic.com there is a lot of

analysis of the housing and mortgage markets, including foreclosure information.

Recently CoreLogic released their report 2016 Housing and Mortgage Rates

Forecast.

They report that expectations for 2016 show

that the Fed will probably raise short term interest rates by one percentage

point gradually over the year. This is expected to cause mortgage interest

rates to rise by around a half point, to around 4.5% for the 30-year fixed rate

mortgage. Those of us who remember rates in the past averaging more in the 6%

to 8% range probably aren't too excited about these historically low rates.

However, particularly with first time home

buyers, the mortgage interest rate influences the amount of the payments and

the value of the home loan for which they can qualify. Even with discouraging

mortgage rate increases, a modest increase in the number of home sales over

those in 2015 is expected. Refinancing activity is expected to drop however.

An improving labor market is expected to

spur household formations in 2016, with 1.25 million new households expected.

More households will spur demand for both purchases and rentals, but rentals

will get the most pressure. With rental vacancies already at the lowest levels

in 20 years, rents should be rising more. This could move some buyers from

renting back into the market.

Even with just a modest increase in the

number of sales, it's still going to be another consecutive year with more

sales than in any year since 2007. Rising demand is going to help prices to

continue to rise. The CoreLogic Home Price Index showed a year over year

increase of 6% over the past 12 months.

It's been a whole new housing analytical

world since the housing and mortgage crash. We still have owners holding on and

not listing, and that's keeping inventories low. Depressed inventory is as

responsible for rising prices as modestly increasing demand. First time home

buyers are still avoiding the market in droves compared to pre-crash historical

numbers.

At some point low inventories and rising

demand could bring prices to a level that will bring sellers back into the

market. Many are still making up for equity lost during the crash, and some are

still underwater in their mortgages. When they do start listing in more normal

numbers, then we could see some slowing of price increases and maybe more

demand.

It's tough predicting the new real estate

markets. CoreLogic is one of many companies publishing reports and projections.

I'm sure you can find others with different conclusions, and real estate

investors have a constant stream of date through which to sift for trends. We

are constantly evaluating our markets and seeking opportunities. I don't see

anything really negative about rental investing over the next few years, so

have fun!

http://www.huffingtonpost.com/dean-graziosi/2016-predictions-mortgage_b_8911614.html

Wednesday, December 16, 2015

How to Prepare Your Home for the Winter

The winter months can be difficult for homeowners as they face increased utility usage and weather conditions that can cause damage to the home. Kiplinger.com recently posted a slideshow advising of 15 ways to prepare your home for the winter. Their suggestions include:

· Tune up your heating system

· Reverse your ceiling fan

· Steps to prevent ice dams

· Check your roof for damaged, loose, or missing shingles

· Caulk around windows and doors

· Clean the gutters

· Divert water

· Turn off exterior faucets

· Drain your lawn – irrigation system

· Mulch leaves when you mow

· Prepare your mower for winter storage

· Wait until late winter to prune trees and shrubs

· Test your sump pumps

· Clean chimney and vents

To view Kiplinger’s entire slide show: http://www.kiplinger.com/slideshow/real-estate/T029-S001-12-ways-to-prepare-your-home-for-winter/index.html

Subscribe to:

Posts (Atom)